FALL 2024

Goalify | App Development - Group Project

Group Members: Audrey Meagher, Kayma Jacobs & Santiel Buckley

PROBLEM STATEMENT:

It is difficult for post-grad students in America to navigate their life financially because they lack the awareness of available resources that can reassure and support them. This creates a sense of uncertainty and loss of hope that becomes a barrier to seeking help, leading to poor money management, mental stress, social pressure, and delay of their future goals & dreams.

PRODJECT DEFINITION:

This project is an educational resource that provides young adults with financial resources catered to their specific financial problem areas and how to achieve their life goals. These resources will include things like proper spending habits, saving tech-niques, debt management and state benefits. This will reassure them on the availability of information and tools that can provide more hope for their financial future and goals.

Research Landscape

MENTAL HEALTH

Individuals facing financial difficulties are more likely to experience symptoms of depression and anxiety.

LIFE MILESTONES

We found that roughly 81% of adults with student loans say their debt has caused them to delay important life milestones, such as buying a home, getting married, or starting a family.

TARGET AUDIENCE

Generation Z has a lower financial satisfaction rate than other generations and is more financially illiterate.

Problem Frame

Many recent college graduates and young adults see their personal finances as a source of anxiety. Rising tuition costs are leading to a higher average in student loan debt, leaving many graduates feeling behind financially before they even start their careers.

Survey Results

Answers were collected from 30 participants aged between 21-24 who are either college students or recent graduates. (October, 2024)

OUR FINDINGS

The optimism trends related to expectations of paying off their debt. No one is 100% optimistic—the relation between using tools and struggling financially.

To provide financial tools that help people gain confidence in their financial knowledge.

OUR PLAN

User Persona

CREATED BASED ON SURVEY RESULTS

Kassie is a recent graduate who is excited about starting her career but feels overwhelmed by her financial situation. Between managing rent, student loans, and trying to save for a future home, she often feels like she is falling behind. Kassie also has a deep love for travel and dreams of exploring new places, but with her current financial stress, it feels impossible to afford even a weekend getaway.

She feels hopeless with her student debt and the distant goal of owning a home. She is not currently using any financial management tools, which leaves her feeling more uncertain about her next steps.

MEET KASSIE!

GOALS

Research Conclusion

We found that financial struggle and navigating the overwhelming amount of information have become a significant barrier to young adults seeking financial freedom and hoping to reach their life goals.

How might we educate those who feel hopeless about their finances and achieving their dreams?

Proposed Outcomes

IMMEDIATE

People have the necessary tools accessible to them so they can pay off debt and become financially stable.

INTERMEDIATE

People can then hit life milestones now that they are becoming more financially free.

ULTIMATE

People build enough financial wealth that can benefit their future generations.

SKETCHES

GENERATIVE RESEARCH - ROUND 1

We discovered that users would prefer to have an app format rather than a web page, giving a more personal experience.

GENERATIVE RESEARCH - ROUND 2

Users felt there was some inconsistency and were still unclear on certain functions and motivations for use.

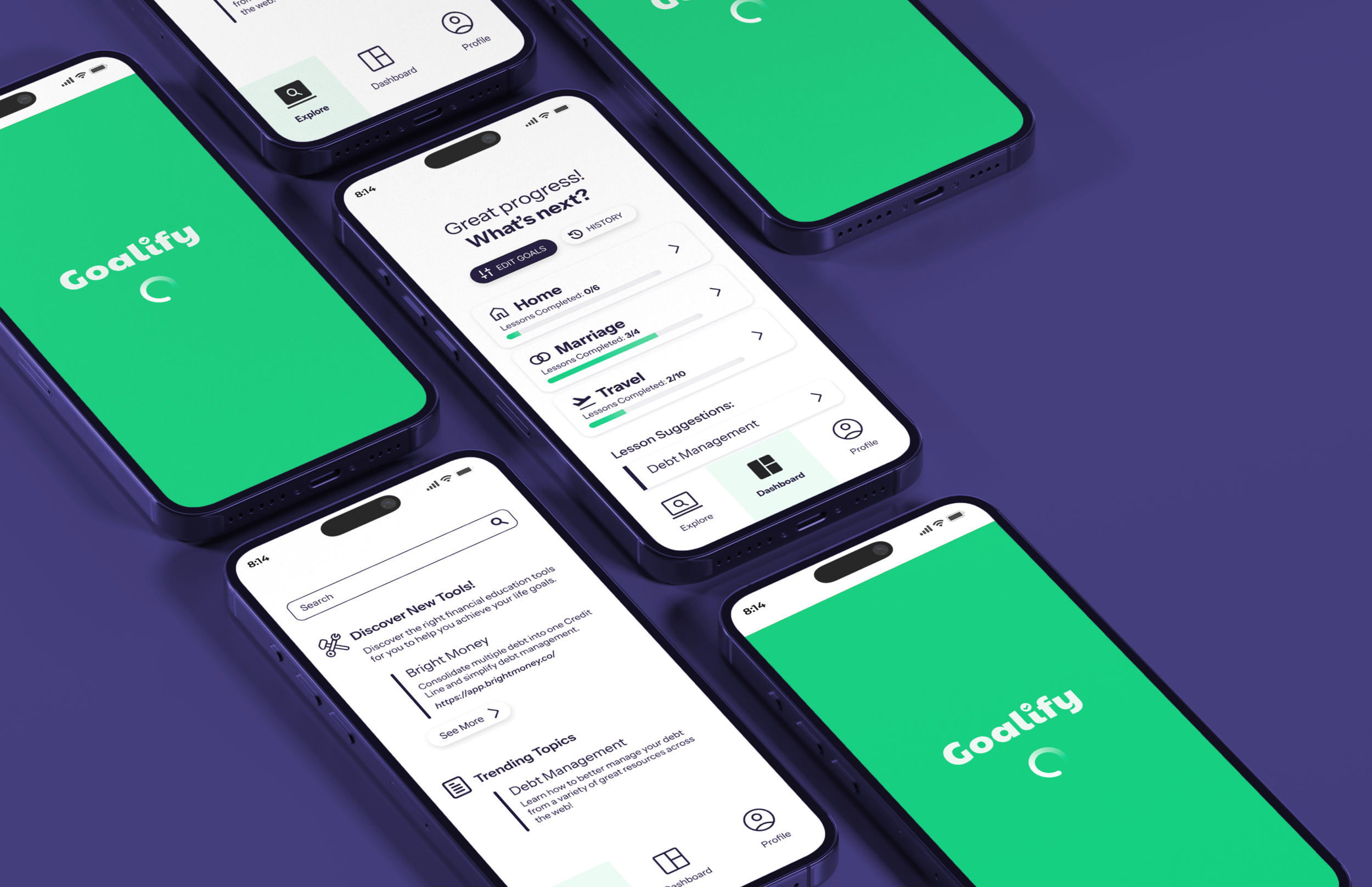

FINAL PROTOTYPE WALKTHROUGH

SOURCES

Boldizar, Ava. “Ohio Ranks among Worst States in Country in List by U.S. News & World Report.” NBC4i, www.nbc4i.com/news/data-desk-ohio/ohio-ranks-among-worst-states-in-country-in-list-by-u-s-news-world-report/.

Community Well-Being Index, Sharecare. “Depression Risk and Financial Health Are Intrinsically Connected.” Sharecare, February 7, 2023. https://wellbeingindex.sharecare.com/depression-risk-and-financial-health-are-intrinsically-connected/.

Hess, Abigail. “CNBC Survey: 81% of Adults with Student Loans Say They’ve Had to Delay Key Life Milestones.” CNBC, January 28, 2022. https://www.cnbc.com/2022/01/28/81percent-of-adults-with-student-loans-say-they-delay-key-life-milestones.html.

Kiernan, John S. “WalletHub Student Money Survey.” WalletHub, May 1, 2024. https://wallethub.com/blog/student-money-survey/60207.

Makachoska, Martina. “21 Eye-Opening College Student Stress Statistics for 2023.” What To Become, May 20, 2023. https://whattobecome.com/blog/college-student-stress-statistics/.

McCann, Adam. “States with the Most and Least Student Debt (2024).” WalletHub, July 31, 2024. https://wallethub.com/edu/e/best-and-worst-states-for-student-debt/7520.